Wealth management

Peace of mind in an unstable world

‘We live in a world of risks and rapid changes and we want to ensure our wealth, the safety of the future of our children and also our elderly years. For this, we need an expert company with decades of experience and efficiency to help achieving our goals. We work in this spirit at Concorde and ensure the peace of mind of our clients by increasing their wealth continuously above inflation in a balanced way with our wealth management service.’

György Jaksity – founder, chairman of the Board

Wealth management at Concorde

Actively managed portfolios with the purpose of preserving wealth and increase it above inflation. Absolute return portfolio management approach: non indextracking portfolios, our aim is positive yield in all market conditions. Conservative approach: the ratio of each asset class is not constant, no constant equity exposure – our ambition is a portfolio with low volatility.

Effective portfolio management: with the wealth management mandate it is possible to react to market changes quickly – our Investment Committee takes decisions and executes them immediately. Convenient: implementation does not require continuous contribution of the client. Flexible: capital can be raised and withdrawn out of the portfolio flexibly. With a long-term investment account tax-free yields are available.

Investment decisions

Investment decisions are made by the Investment Committee including members like György Jaksity(chairman of the Board), Tamás Móró (head of strategy), János Samu(head of research). Investment decisions are also backed up by our research team, which won the ‘Research Team of 2015’ award.

Portfolios following Concorde’s recommendations

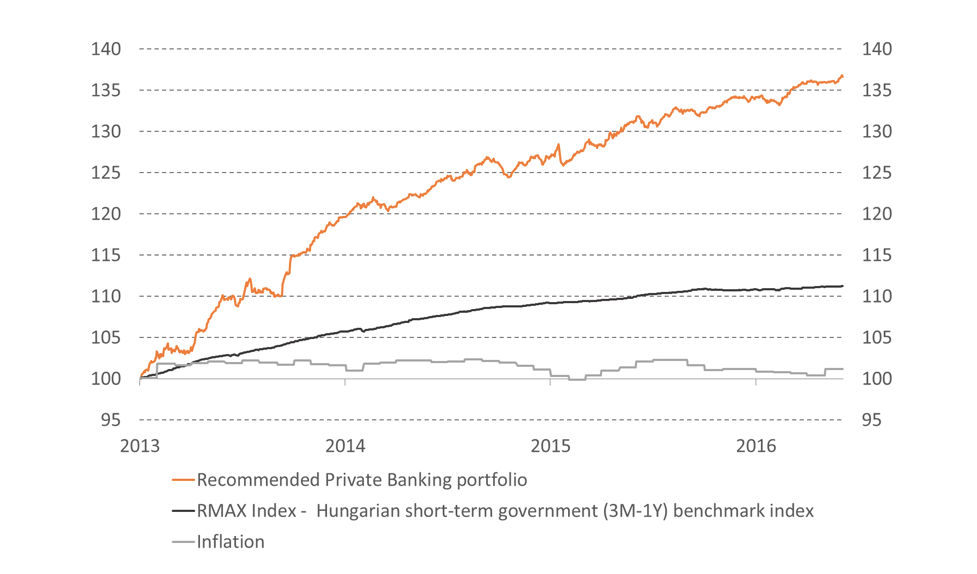

1. Performance of the recommended private banking portfolio

(compared to inflation and returns realised on short-term government securities)

Our recommended private banking portfolio outperformed the price level change and the returns realised on risk-free, liquid investments.

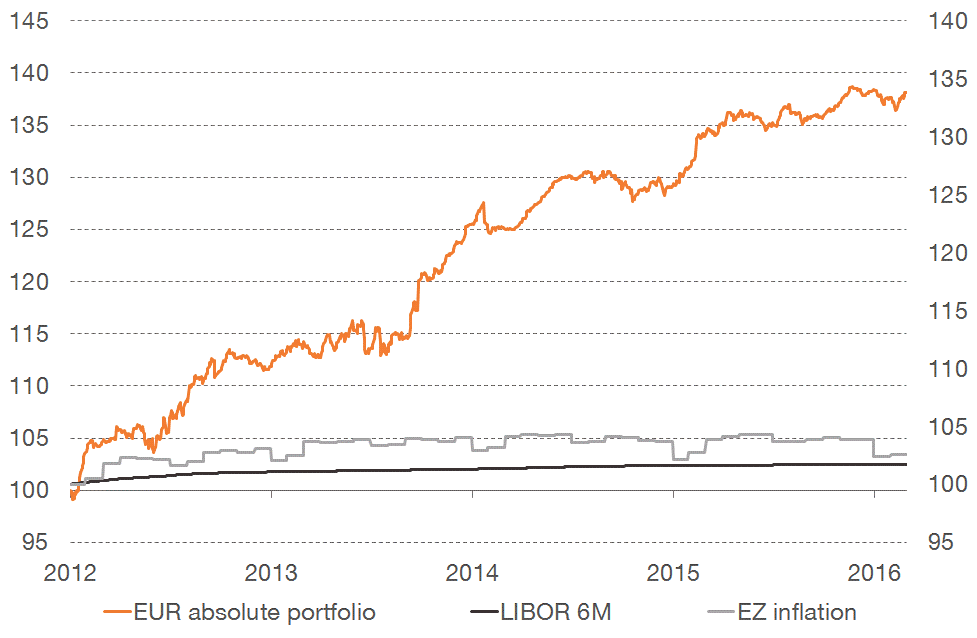

2. Performance of the euro-denominated absolute return portfolio

(compared to inflation rate within the euro area and interbank returns)

Our clients following Concorde Securities’ recommendations were also able to realise returns many times beyond those of risk-free euro-denominated investments, and well above inflation. Even so, the value of the recommended portfolios showed little volatility.

162